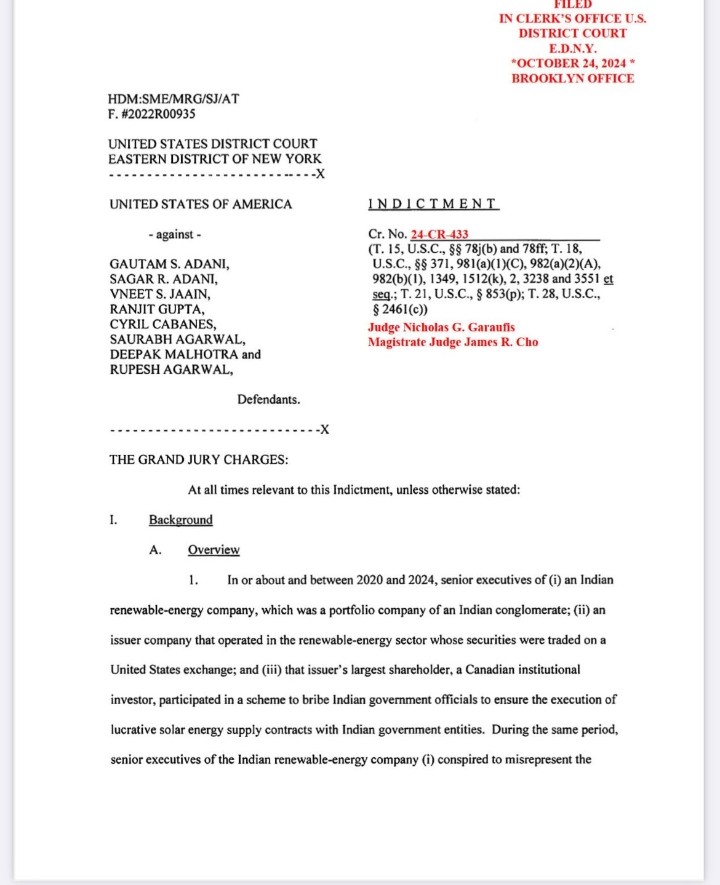

Arrest Warrant Against Adani in US: The Case and Its Background

One of the world’s richest industrialists, Gautam Adani, who heads a conglomerate that includes diverse sectors such as ports, mining, energy, renewables, railways, roads, aviation, edible oils among others, has been indicted by US prosecutors in an alleged $250 million bribery case seeking favours for solar power projects, reports the Financial Times.

The business tycoon, perceived as close to Prime Minister Narendra Modi, along with seven other senior executives have been charged with “bribing Indian officials” and “concealing” it from US banks and investors.

“He (Gautam Adani) was charged alongside seven others, including executives of Adani energy subsidiaries and former employees of a Canadian pension fund. His nephew Sagar Adani, who is the executive director at a renewables company founded by Gautam Adani, is also among the defendants,” said the FT report.

The indictment notice alleged that they “orchestrated an elaborate scheme to bribe Indian government officials to secure contracts worth billions of dollars and Gautam S. Adani, Sagar R. Adani and Vneet S. Jaain lied about the bribery scheme as they sought to raise capital from U.S. and international investors.”

According to the FT report, “US federal prosecutors said more than $250mn in bribes were “offered and promised” between 2020 and 2024 to people in the Indian government as part of the scheme, which was allegedly concealed from the US banks and investors from which they raised billions of dollars. They claimed that Gautam Adani met an Indian official to “advance” the scheme.”

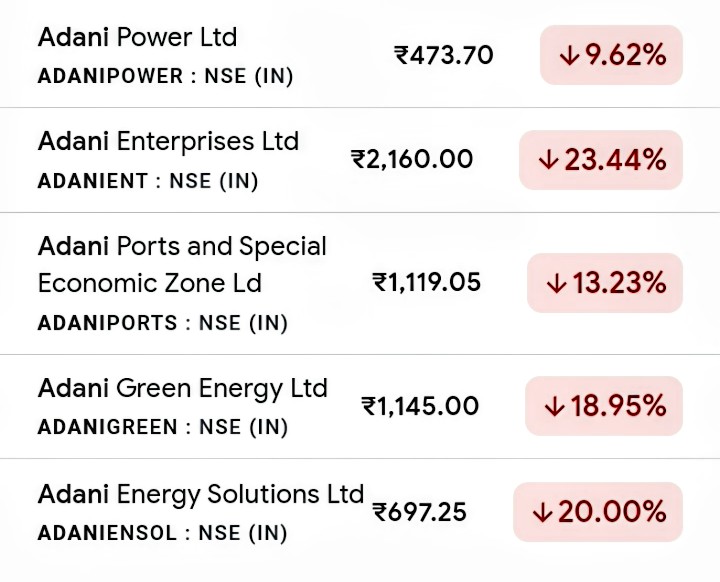

After the indictment, shares of the Adani Group’s 10 listed companies tumbled in the stock market in India.

Recall that the Opposition parties led by Congress leader and Leader of Opposition Rahul Gandhi have been repeatedly demanding a Joint Parliamentary Committee to probe into allegations of stock manipulation by the Adani group, more so after a damning report by US short-seller Hindenburg Research, as also into the alleged role of market regulator SEBI chief Madhabi Puri Buch.

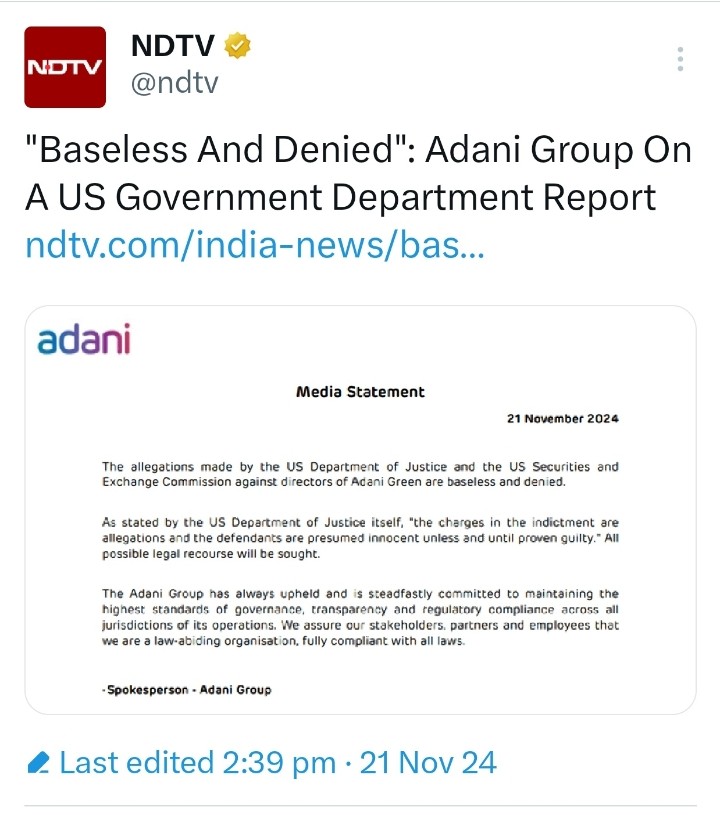

Meanwhile, the Adani Group in a statement denied the allegations made by the US Justice Department against Adani Green officials as “baseless.” It said it ill seek “all possible legal recourse.”

This article was originally published in NewsClick and can be read here.