Huff, Puff and Rebuff at the Rating Downgrade

The sub-prime crisis upended the U.S. economy in 2007. President George W. Bush found it convenient to arraign the credit rating agencies for the fiasco. They had a harrowing time facing the crisis of confidence.

Jharkhand-born Deven Sharma had just moved in to head Standard & Poor (S&P) in the U.S. Four years later, Standard & Poor found it appropriate to downgrade the U.S. Government’s long-term debt rating from AAA to AA-. Barack Obama was at the helm then. He too fumed and fretted against the rating agencies. Senator John Kerry chose to dismiss it as “Tea Party Downgrade”. Damned if you, damned if you do not! Deven Sharma resigned from S&P after 18 days of piloting this rating downgrade, which was the first of its kind in 70 years. The Federal Bureau of Investigation (FBI) went after Deven Sharma. Has the Enforcement Directorate in India taken a leaf out of this witch-hunting?

Deven’s team found the debt ceiling stand-off as the reason for this downgrade. This announcement was on a Friday. The markets tanked next Monday. S&P 500 lost 6.5% on first day after the downgrade in 2011. The benchmark U.S. ten-year sovereign bond yield, ideally, must have climbed. But it dropped, possibly at the intervention of the U.S. Federal Reserve.

Twelve years later, Paul Taylor, CEO of Fitch Ratings, decided to bite the bullet. His agency had sent out a downgrade warning in May. It too downgraded the U.S. from AAA to AA+. This announcement was made after the markets closed on Monday. Will he last the next 18 days? The ides of August need to be watched. Deven of S&P could not withstand the 18-day war of Mahabharata! Beyond the debt ceiling standoff, deteriorating governance concerns and fiscal profligacy have combined to press Fitch to effect the downgrade.

A day after the downgrade in 2023, S&P 500 shed 1.38%, NASDAQ Composite Index lost 2.17% and the benchmark U.S. ten-year sovereign yield rose by 2.4% to 4.08%. On the second day, the yield was further up at 4.11%. A rating downgrade reflects heightened default risk. But the credit default swap levels have remained unmoved. Perhaps, a one-notch dip from the top is too far away from default. If the safe haven theory should hold good, gold price must have gone up. But it dropped by 0.5% to $1934 per ounce, as in 2011. Down the line, will any rating agency downgrade the rating for gold!

Just like the market, reactions of people who matter have been on predictable lines. Janet Yellen, the Secretary of U.S. Treasury and Jerome Powell, Chairman of Federal Reserve, have rebuffed the rating action, accusing Fitch of relying on inaccurate data. Are they questioning their own data? While Fitch is now aligned with S&P on U.S. debt rating, Moody’s is still maintaining the AAA rating.

Globally, ten economies still retain the AAA rating by Fitch and 11 by S&P. Of the 11, Canada is rated AA+ by Fitch. Australia, Denmark, Germany, Liechtenstein, Luxembourg, Netherlands, Switzerland, Norway, Sweden and Singapore make up the rest of the ten. (www.tradingeconomics.com) India too can boast of a double A in its rating, albeit with a “B” at the front and 3 at the end, making it “Baa3” with astable outlook, pecking it at the lowest of investment grade rating.

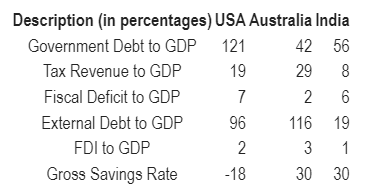

Let us look at the following data across the U.S. (AA+), Australia (AAA) and India (Baa3) to understand if such rating divergences really reflect underlying weaknesses or perceived strengths. Data is as of March 2023, sourced from info.ceicdata.com.

With the government debt to GDP remaining at 121%, the U.S. economy is puffing along on borrowed money. The next table will reveal that the holding of this debt by the U.S. is negligible, bracketed with others at 2%. This is also corroborated by the high external debt to GDP ratio of 96%. Yet, the U.S. perceived itself to be safe for more than eight decades! At 7%, the U.S. has the highest fiscal deficit to GDP among the three. Fitch has rightfully expressed heightened concerns on fiscal profligacy. U.S. citizens appear to have been so pampered with social security and health benefits that they forgot to save for themselves. Their gross savings rate is at negative 18%. “Yatha Rajah, thatha Prajah”. Just like the government, the citizens are also enjoying living on borrowed funds. Yet, US claims to be safe haven!

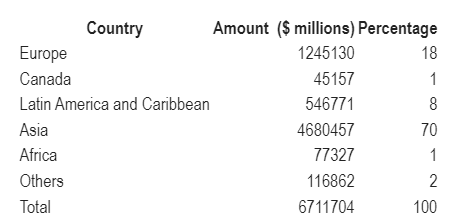

Asia (led by China) holds 70% of U.S. debt. The U.S. is bracketed with others and still comes to less than 2%. Clear examples of leveraged economies that preach to the corporate world on high gearing!

It is high time U.S. citizens made themselves aware of the sixth verse in Bhagavad Gita Chapter 3.

karmendriyāṇi sanyamya ya āste

indriyārthān vimūḍhātmā mithyā

Those who restrain the external organs of action, while continuing to dwell on sense objects in the mind, certainly delude themselves and are to be called hypocrites.

The mention of the “mithyachara” by the Lord is about the hypocrites, who find it convenient to huff, puff and rebuff as per their convenience. The ones who extoll the “façade” in Johari Window need to remove their facades fast.