What do you get when a former senior banker with a journalist’s flair and a satirist’s wit dreams of interviewing the RBI Governor? A hilariously insightful take on the Monetary Policy Committee’s latest moves—delivered through a fictional chat with the late Arthur Buchwald himself. Set in the imaginative space between fiscal policy and dream logic, this playful piece dissects repo rates, risk weights, and regulatory stances with humor, perspective, and just the right dose of irreverence. Because sometimes, monetary policy needs more than numbers—it needs a nudge, a laugh, and a little dreaming.

(Below created characters and conversations are purely imaginary; might or might not reflect reality; Intention is not to hurt anyone, but to generate a debate. If it hurts anyone, my sincere apologies to him/her)

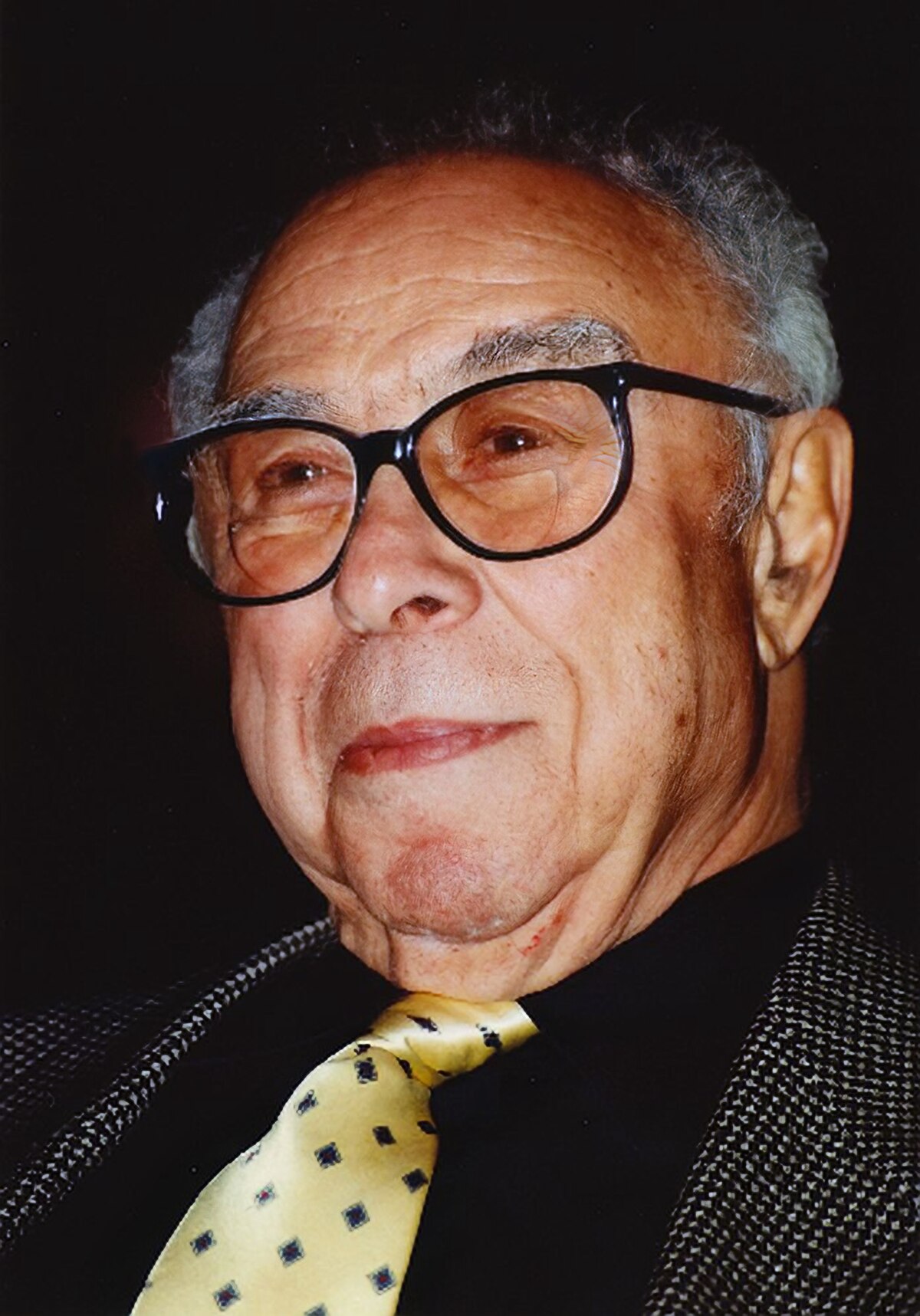

I was a fan of the late Mr. Arthur Buchwald (AB) (1925-2007) in my younger days. He was one of the sharpest political satirists and was a regular columnist in The Washington Post. His ‘imaginary interviews’ with the US political bigwigs then, attracted a lot of viewership and at the height of his popularity, across the nations, more than 500 newspapers carried his syndicated column. (The Hindu was one of them and I read his articles, as my father insisted that I read an English news daily every day, to enhance my vocabulary skills). I was reminded of AB, when I heard the present RBI Governor’s first statement on 7th February 2025 on the Monetary Policy Committee’s (MPC) review on repo rate and its stance. More than the 25 bps cut in the repo rate, which was expected, I was fascinated by his statement that any regulation to enhance stability and consumer protection involve costs and that sufficient time will be given for implementing the proposed changes in LCR, ECL framework, provisioning norms for projects under implementation. RBI followed up his statement, by restoring the earlier risk weights on loans to NBFCs and micro finance, for the purpose of calculating the capital adequacy of scheduled commercial banks (SCBs).

I listened to the RBI Governor again on 9th April 2025. The rate cut by 25 bps was again on expected lines. But the purpose of the monetary policy stance revised to “monetary policy to be growth supportive, while being watchful on the inflation” from what used to be the stated role of MPC viz. “to ensure that inflation progressively aligns with the target, while supporting growth” raised a few eyebrows. His explanation that “accommodative stance” means guidance on policy rate (whether to maintain a pause or cut the rate) and should not be confused with liquidity measures was educative. As the stance of the new governor appeared to be different and is fresh from a commercial banker’s perspective, (I am an ex-banker!) I requested my favourite writer AB to have an interview with the new Governor of RBI (when AB chatted with me in my dream last night). Since AB is now in Aroopa form (formless) and the RBI Governor might be preoccupied otherwise, AB preferred an imaginary interview with me (in my dream) with a condition that my answers should be in line with what might have been the response from RBI, as per general perception. I told him that I am an ex-banker, not privy to any general perception and the answers will be as per my own perception.

Excerpts of the interview in the ‘dream’ are as under

AB: During the rate hike cycle, whenever there was a pause in the repo rate on an occasion, the rationale given out is that the transmission of the repo rate is not fully reflected in the lending rate and time should be given for pass on. The reduction of 25 bps in repo rate in Feb’ 25 is passed on only to the existing loan customers whose interest rates are linked to repo rate. The new customers covered under the floating rates linked to the repo rate or the internal benchmark rates are not yet benefited. Could RBI have waited now?

Me: CPI inflation rate is falling since Dec’ 24 and for the month of Feb’ 25, it was below the target rate. If there is no reduction now, the real interest rate will be higher. Moreover, the role of MPC is to align the repo rate as per inflation dynamics and not with whether transmission takes place or not.

AB: In the last 12 months, only in a few months, CPI inflation was below the range of +/-4% target rate fixed for inflation. In the above circumstances, can we assume that the durable inflation is likely to be aligned with the target rate in future.

Me: MPC is watchful on the inflation front and will take a call, if the inflation erupts again.

AB: Immediate transmission takes place in money market instruments and dated G-Sec, whenever there is a change in the repo rate. Is RBI trying to favour the government to conduct its borrowing programme at reduced costs?

Me: Growth happens, when the government starts spending. This is a universal phenomenon. RBI is growth supportive and to that extent, if the government borrowings are at reduced costs, it serves the purpose.

AB: Implementing proposed changes in LCR, ECL framework and provisioning norms for projects under implementation would have been ideal now, as all the banks are at least 100-150 bps above the regulated capital adequacy ratio (CAR) of 11.5%. But RBI said it will not implement them before March 2026. Again restoring the earlier risk weights for NBFCs and micro finance was not called for, since the present CAR of the SCBs indicate a comfortable position, even after accounting for the changed risk weights in those categories.

Me: Growth happens only when the business levels are sustained and grown. The actions implemented and proposed will enable the banks to concentrate on business growth freely without the apprehension of the above factors kicking in, impacting CAR in the process.

AB: Even in respect of NCLT cases, it is evidenced that the recovery rate averages above 30%. In that scenario, whether the regulator can think of reducing the static provisioning norms on doubtful three/loss assets to 75% instead of the usual 100%. This will improve net profit and CAR.

Me: This appears to be a good suggestion. I intend to post our ‘imaginary interview’ in my blog. Will get the views of the readers.

AB: The present liquidity in the system appears to have emanated from the accretions in the bank accounts of retail investors, due to the sharp decline in the stock values in the market. It is also reported that mutual funds are sitting on a pile of cash, kept available in their bank accounts. As this may be temporary, to have durable liquidity, why not reduce the statutory liquidity ratio by 100 bps (from 18% to 17%). This will make available funds to banks for deploying in assets fetching higher returns.

Me: CRR and SLR are first lines of defence to the banks and cannot be compromised for liquidity constraints. Moreover, this helps the government to keep its external borrowings at nominal levels as compared to GDP.

AB: Is there a perception that by filling up the vacancies of RBI Governor, Chairman of SEBI and the new Finance Secretary with persons, who worked in the ministry of finance/commerce in their prior assignments, the regulators are enabled to work with the fiscal policy makers on the same page?

Me: I refuse to answer this question, as I am neither a beneficiary of these appointments nor am in the body of decision makers. I also object to ‘leading’ questions.

With the above protest, I woke up and the dream ended. So did the interview.

Insightful, creative and hilarious..Kudos