So what are the implications of the January 2, 2023 Supreme Court verdict on Prime Minister Narendra Modi’s November 8, 2016 enforcement of demonetisation of Rs 500 and Rs 1,000 notes ? Indeed, the five-judge constitutional bench of the Apex Court upheld the controversial decision with a 4:1 verdict. But, what does it mean in real terms, for the people? According to the four judges of the five member bench – Justices B R Gavai, S Abdul Nazeer, A S Bopanna, and V Ramasubramanian – the government’s action was legal. They also concluded that there was no flaw in the decision-making process. It is also known that it was Justice Gavai, who wrote the judgment for himself as well as others. However, in her dissenting judgment, Justice B V Nagarathna disagreed with the reasoning and conclusions in the majority opinion. Justice Nagarathna termed the entire demonetisation exercise not in accordance with the law and raised crucial questions over the Reserve Bank of India’s institutional independence.

The case had come to this five-member bench when Justice A.M. Khanwilkar and Justice Dr. D.Y. Chandrachud decided on 16th December, 2016 to refer Case No. WRIT PETITION (CIVIL) No.906/2016 to a larger bench. The additional factor in the timing of the judgment is that it has been delivered just 3 days before the judge heading the bench was to retire. Significantly, the judgement of the 4 judges is evidently incomplete as it has referred matters again to the Registry. It stated as follows. “Having answered the Reference, we direct the Registry of this Court to place the matter before Honourable the Chief Justice of India for placing it before the appropriate Bench(es). Needless to state that all other contentions are kept open to be considered by the Bench(es) before which the matters would be placed.” When this will happen is not known. But there is also the fact that as and when it happens, the consideration of “all other contentions” and its merits would only be an academic exercise as the damages caused by demonetisation cannot be undone.

One needs to rewind to the period when demonetisation was implemented and the proclamations that accompanied it to get a sense of these damages. Let us consider the following. On Nov 8, 2016, while announcing demonetisation, the Prime Minister told the citizens that “For years, this country has felt that corruption, black money and terrorism are festering sores, holding us back in the race towards development.” He went on to add that enemies from across the border run their operations using fake currency notes. He also made the following additional points, “The magnitude of cash in circulation is directly linked to the level of corruption. Inflation becomes worse through the deployment of cash earned in corrupt ways. So, in this fight against corruption, black money, fake note and terrorism, in this movement for purifying our country, will our people not put up with difficulties for some days?”

‘Let us ignore the temporary hardship.

Let us join this festival of integrity and credibility.

Let us enable coming generations to live with dignity.

Let us fight corruption and black money.

Let us ensure that the Nations’ wealth benefits the poor.

Let us enable law-abiding citizens to get their due share,’ said the Prime Minister.

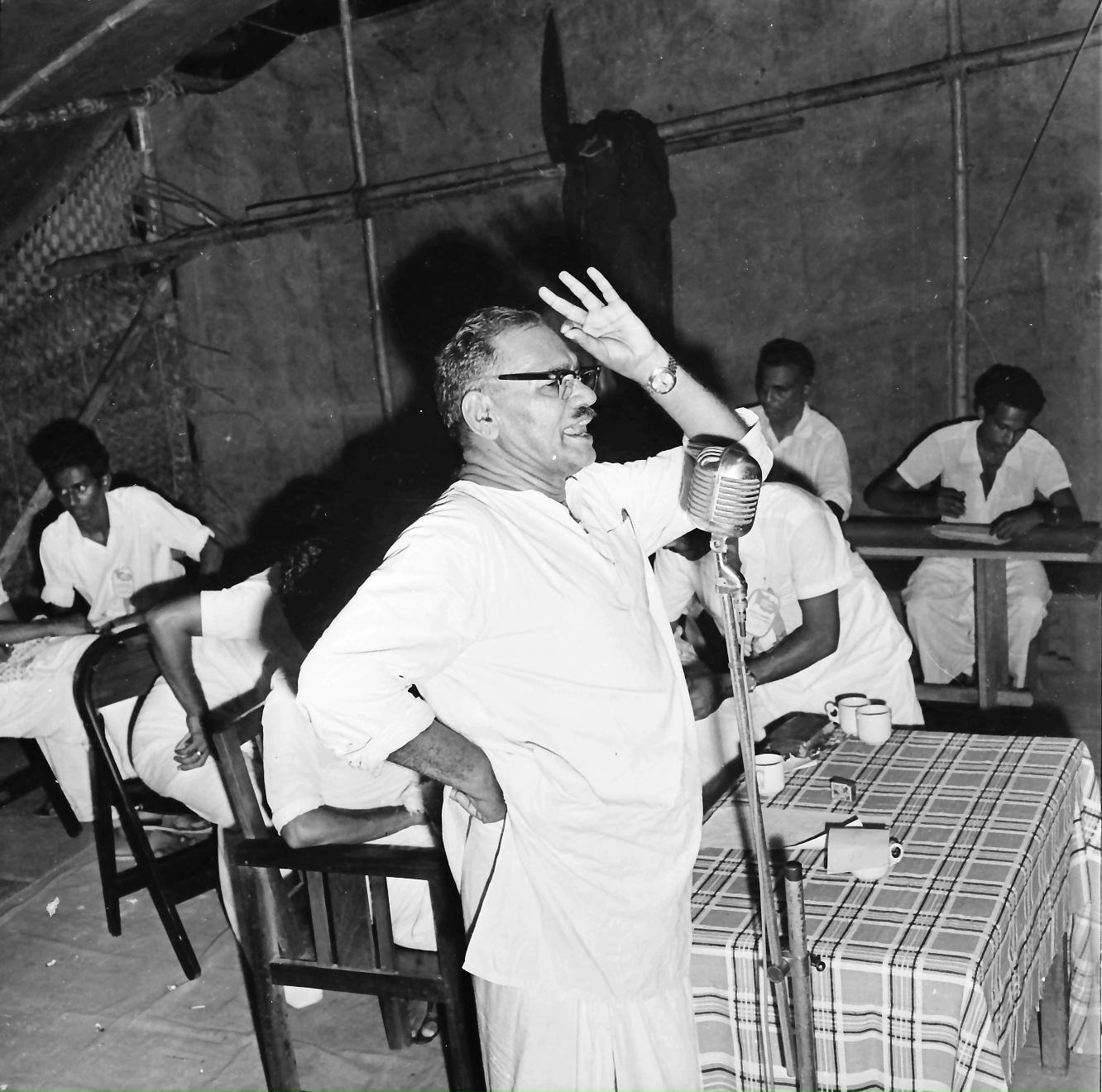

Barely five days later, on Nov 13, probably sensing that the anger of the people on the hardships caused by demonetisation was not subsiding, Modi made an even more emotionally charged speech in Goa, choking repeatedly during the speech. That emotion charged display was interpreted as virtuous assertion of a leader of the people. At Goa, Modi said that “I have asked the country for just 50 days. “If after December 30, there are short comings in my work or there are mistakes or a bad intention found in my work, I will be prepared for the punishment that the country decides for me.”

He also stated that, “This is a 70-year-old disease I have tried to eliminate in 17 months. I am away what they have accumulated in 70 years”. He also talked about more projects to fight corruption. It was a dramatic performance that certainly gave a run for the money renowned superstar thespians like Sivaji Ganesan and Amitabh Bhachan. Do take a look at this video to see how it panned out. But, what ultimately came out of all these theatrics?

Put simply, people suffered physical and mental hardships in long and winding demonetisation queues that kept them in line for hours on end, facing the vagaries of the weather . Bankers were forced to do overtime for days on end. Estimates are that as many 104 people including 12 bankers lost their lives on account of demonetisation hardships. A total of 58 Persons went to court challenging the government move and highlighting the hardships it had created. All petitions were clubbed and referred to the 5-member bench of the Supreme Court.

In the Judgement the judges quote Congress leader and renowned lawyer Chidambaram’s questions on the process that was adopted to announce demonetisation. The judgment states as follows. “ The learned Senior Counsel submitted that, the Central Government which initiated the proposal for demonetization and sought opinion of the Central Board vide its communication dated 7th November 2016. The meeting of the Central Board was held immediately on the next day i.e., 8th November 2016 at 5.00 p.m. Within hours, a recommendation of the Central Board was sent to the Central Government and, on the same date itself, i.e., 8th November 2016, The Honorable Prime Minister announced the decision of the Cabinet with regard to demonetization on National Television at 8.00 p.m. “

An interesting information which has come up through the records of the hearings of this case is that few days before Nov 8, 2016 fresh Rs.2000 notes had reached Currency Chests of banks and kept in boxes without including them in the reporting format called Currency Chest slip. Who decided this? Shyam Divan, learned Senior Counsel appearing on behalf of the applicant-Malvinder Singh, also made crucial submissions. He pointed out that apart from the guarantee given by the Central Government with regard to exchange of every bank note as legal tender at any place in India, they are also the liabilities of the Issue Department under Section 34 of the RBI Act to an amount equal to the total of the amount of the currency notes of the Government of India and bank notes for the time being in circulation. He further submitted that the honorable PM, in his speech on 8th November 2016, gave a categorical assurance that the rights and interests of honest, hard-working people would be fully protected. A specific assurance was also given that if there may be some who, for some reason, are not able to deposit their old five hundred- or one-thousand-rupee notes by 30th December 2016, they could go to specified offices of the RBI up to 31st March 2017 and deposit the notes after submitting a declaration form. He submitted that a person of a stature no less than the Prime Minister of India has given an assurance that such persons would be able to go to specified offices of the RBI up to 31st March 2017 and deposit the notes after submitting a declaration form.

Divan submitted that the applicant/petitioner that he was representing withdrew an amount of Rs.1,20,000/- from his bank account operating in Central Cooperative Bank, Sangrur, Punjab (Branch-Ghelani) on 3rd December 2015 and kept the same with his previous savings of Rs.42,000/- in cash, which totals to Rs.1,62,000/- (i.e. 60 notes of Rs. 500 denomination and 132 notes of Rs.1000/- denomination). On 11th April, 2016, he went to visit his son residing in the USA, leaving his above mentioned saving of Rs.1,62,000/- at home in India for his future knee operation.

The applicant travelled with his wife. During their absence, their home was locked and the money could not have been deposited. After returning to India on 3rd February, 2017, and relying on the assurance given by the PM, he made a representation to the RBI for exchange of the currency notes in his possession. However, the same was not considered, thus constraining him to file a writ petition. Divan submitted that the proviso to the Notification dated 30th December 2016 issued by the Ministry of Finance, Department of Economic Affairs, Government of India, totally excluded persons like the applicant, he was representing. On account of the number of days residing abroad, the applicant was categorized as non-resident Indian and as such, he was only entitled to exchange currency notes to the extent as provided in the proviso to the Notification dated 30th December 2016. Significantly, the applicant had not carried the cash while travelling abroad and as such, there was no question of making a declaration under clause (i) of sub-section (1) of Section 4 of the 2016 Notification.

Divan also pointed out an article titled “Using Fast Frequency Household Survey Data to Estimate the Impact of Demonetization on employment” by Mahesh Vyas, of the Centre for Monitoring Indian Economy (2018) in support of his submission that on account of demonetization, there was substantial reduction in employment, which was about 12 million lower than it was during the 2 months preceding demonetization. And, over a 4-month period when the entire sample was surveyed, the impact of demonetization reduced to a loss of about 3 million jobs. He also submitted that an article of the Indian Express dated 17th January 2017, which was based on a study conducted by the All India Manufacturers Association (AIMO) that showed that the manufacturing sector suffered from considerable job loss post-demonetization. Beyond these harsh facts highlighted in the records of the hearing of the case we also need to and ascertain whether the original objectives proclaimed by the Prime Minister was fulfilled.

Whether objectives fulfilled?

The objectives told by Modi on November 8, 2016 were, abolition of black money, fake notes, corruption and ending terrorism. Later on, when the government realised that their estimates on Rs. 3-4 lakh crores will not come back to RBI was going awry, they changed the goals to include cashless economy. In reality out of the 15.41 lakh crores of invalidated notes supposedly in circulation at that time Rs.15.31 lakh crores returned to RBI. This changing tack operation was taken forward by the Prime Minister saying, “Demonetisation has helped to reduce black money, increase tax compliance and formalisation, and given a boost to transparency. “He also claimed that these outcomes have been greatly beneficial towards national progress.”

But the fact of the matter is that none of the objectives proclaimed by the Prime Minister have been fulfilled. Black money, corruption, fake notes and terrorism persist to cause continuous harm to the country and its people . Let’s have a look at the reality. We see the largest use of cash in elections. Is it not black money? We see crores of money spent to purchase MLAs. Is it not black money? Is it not corruption? RBI and banks had full details of serial Nos. of new notes. If the CBI and other agencies would have wanted to find the source from which new currencies in crores reached persons with political connections it could have been very easy. Why this was not done? Another factor is regarding the scarcity of Rs. 2000 notes. These are seldom available even in ATMs. Where have they disappeared? The RBI also says only 1.6% of the Rs. 2000 notes are accounted for in banks in its Annual Report 2022. That means the rich are hoarding the rest. Is it black or white?

The RBI Annual Report 2022 reveals that we have 31 lakh crore notes in circulation as against 18 lakhs which were there during demonetisation. As on December 2022, it has increased to 32.41 lakh Crores. The RBI earlier stated that 99% of the specified bank notes (SBNs) had been returned to the RBI. Then where is the black money? The government told the Supreme Court that more Income Tax Returns have been filed. But unfortunately, there is not much increase in the amount of income tax collected other than natural growth. Demonetisation had nothing to do with that. Indeed, there is an increase in digital transactions, but cash continues to be supreme everywhere as seen from the RBI data itself.

Fake Currency, Corruption and Terrorism

As per RBI data, in the last 4 years 18.87 lakh pieces of fake currency were seized. We don’t know how much is in circulation. There is a sense, in some financial circles, that it has become easy to print Rs. 2000 notes and that fake currency is now very difficult to differentiate due to high quality printing. The RBI Annual Report 2022 shows that the number of fake notes detected in the banking system has doubled. In Rs. 500 denominations, from 39453, it has increased to 79699 in one year and the Rs 200 denomination fake notes have increased from 8798 to 13604. As reported above, most of the 2000 denomination notes are not in circulation, but we still have a large number of fakes. Only a small fraction of the fake notes is detected in banks and reported. The RBI report does not even account for the fake notes seized by the police and defence forces. So fake notes have not been abolished. The big question is when there are so many fake notes coming to banks, why is the government not in a position to find out where they are printed?

Has corruption ended? From registration office to the top people in government, common people know that nothing moves without corruption. There were 155 well documented cases of seizure of huge amount of new currency from individuals. Not a single case has led to punishment. A classic case is that of a former chief secretary of Tamil Nadu and a contractor in Tamil Nadu. The officer was reinstated and now he has retired on superannuation. The contractor is a member of Tirupati Devaswom Board now.

Clearly, the government, especially the Finance Ministry and RBI have a lot to answer. While the decision to demonetise cannot be reversed, the arguments presented in court cannot be deemed as something which is of academic interest alone. As is evident, the implications of these with regard to policy-making in the country and the institutional integrity of important financial institutions are of a very high order. At the end of it all, on the basis of the court proceedings of this case and the judgment itself, especially the dissenting judgment, certain questions to the Prime Minister are also justified. Especially, in the context of his theatrical performance of November 13, 2016.

Well, to put the questions directly: Is it right to fool the people of the country on as crucial matter as money in circulation? Is it not necessary for a leader to accept the mistakes? To reach where we have reached now, there was no need for demonetisation, because of which 104 people including 12 bankers lost their lives and millions lost their livelihood and employment.

Related Story: The AIDEM Special Focus: What has Demonetization Achieved?

Subscribe to our channels on YouTube & WhatsApp