A Journey Through Major Cryptocurrency Debacles

This is the third part of The AIDEM explainer series that seeks to provide a larger understanding of the complex Bitcoin world. We had titled this series “As Bitcoin Legends Tumble, A Broader Look at the Sector.” The context for giving this title is evident. The month of November had seen a number of revelations about illegal practices in the Bitcoin world and many big players in the sector had come under a shadow. Some top Bitcoin players were even sentenced by the judiciary, including in the US. The first part was titled “The Bitcoin Revolution, A Layman’s Perspective” and the second part “ A Glance at Prominent Cryptocurrencies. This part takes a focused look at cryptocurrency debacles, which have got greater public attention in recent times.

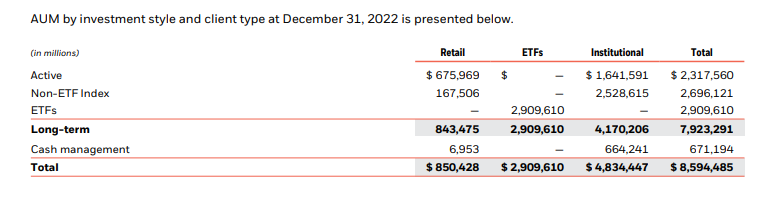

An asset is something that has value because it has utility in some way. On a daily basis, we deal with diamonds, gold, silver, precious metals, physical money, land, buildings, vehicles, and so on. We have also seen non-material assets, such as cryptocurrencies. When the size and value grow, the safe storage and management of material assets become more and more difficult. Asset management is a very serious business. Right from individuals to families to giant companies like BlackRock [1], do asset management. There are varied types of assets people amass, and each one of them has to be dealt with in its own way. The assets have to be protected from adversaries of all kinds. The assets have to be well maintained to retain or grow in value. In many cases, the assets that you own have to be entrusted to a third party for their proper upkeep and management.

Most of the material assets we have seen so far have been around for quite some time. People know how to store or manage them. When compared to other assets, cryptocurrencies such as Bitcoin are very young. People are still learning to store cryptocurrencies and exchange them properly. In this series, we have already seen the Bitcoin ecosystem. In this article, we will look a little deeper into cryptocurrency wallets and cryptocurrency exchanges. A slightly better understanding of these elements will help you appreciate some of the biggest falls we have seen in the cryptocurrency world. Most of the discussions in this article are going to be centered around Bitcoin, where a lot of interesting activities are happening.

Bitcoin Wallet

Bitcoin wallets store the public/private keys for holding and transferring your Bitcoins. It can do transactions such as send and receive Bitcoins. Note that the Bitcoin wallets don’t store your Bitcoins. They are represented on the blockchain as transactions or journal entries. The Bitcoin wallets query the blockchain to get your account balance for the public/private key pairs that you hold in your wallet.

On a regular basis, we use our online banking applications using mobile applications and web applications. It is critical to protect your credentials in order to keep your funds safe. The same holds true for Bitcoin wallets. In the case of your online banking applications, if someone is trying to misuse them, you can reach out to the bank, and in many cases, you could get your lost money back. In the case of Bitcoin, if someone gets hold of your public/private key pair, it is practically impossible to get your lost Bitcoins as there is no central agency controlling the Bitcoin transactions. In this case, you are your bank, and you need to safeguard your account.

Before you begin minting or purchasing Bitcoins, you should thoroughly research the entire ecosystem. There are so many Bitcoin wallets available on the market. It is extremely important to spend a lot of time reviewing them and understanding the way they store your keys and communicate via the internet. Many Bitcoin wallets are open source, while others are proprietary. It is easy to look at the code of open source wallets, but it is tricky with proprietary wallets.

Bitcoin wallets come in many flavours. The two most important categories are hot wallets and cold wallets. Hot wallets will have a live connection to the internet and the blockchain. Cold wallets will not have any of those, and they are used mainly to store the keys safely and prevent any kind of threat originated through the internet.

Software Wallets: The mobile and web wallets are software based and they have connections to the internet and to the blockchain. These are very useful when you want to do frequent Bitcoin transactions.

Hardware Wallets: These wallets don’t have a regular connection to the internet. You can plug them into your computer and do the Bitcoin transactions with their associated software counterpart. Once the device is removed from your computer and safely secured physically, no one can misuse it. If you hold a lot of Bitcoins and don’t have to use them frequently, this is one of the best approaches.

Paper Wallets: This is nothing but a piece of paper on which the public/private keys are printed. These can include QR codes so that the associated software wallets can scan them when you do transactions. There are wallet software programs that could print the keys onto paper. Here again, the safe storage of these printed papers is extremely important. Loss, wear, and tear can lead to lots of fund losses.

Custodial Wallets: These kinds of wallets are typically used by cryptocurrency exchanges or other types of cryptocurrency custodians. This is in use when you don’t use your Bitcoins yourself but someone else is doing the safekeeping of keys and transactions.

Whatever wallet you use, the most important thing to remember is that a careful analysis of the pros and cons is required for the proper safekeeping of your cryptocurrencies.

Cryptocurrency Exchange

Users who are technologically savvy and have thoroughly researched cryptocurrencies can use and transact without the assistance of any exchanges. But most of the investors, users, and traders are not like that. They need help to buy, sell, and transact cryptocurrencies. The exchanges do that service. They will hold your fiat currency, they will procure the cryptocurrencies you want, they will exchange one cryptocurrency with another cryptocurrency, and they will sell based on your instructions. In essence, they are your asset management company. Many exchanges let you manage your own cryptocurrency keys. But many others do custodial services. This Forbes article titled What Are Crypto Exchanges And How Do They Work [2] gives a detailed analysis of various types of cryptocurrency exchanges. Here again, whichever type of exchange you are planning to use, a careful analysis is of great importance in addition to looking at their history and user reviews.

Many cryptocurrency incidents that continue to occur around the world are primarily the result of user error, key misplacement, and a lack of knowledge. These have resulted mainly in the individual’s losses. But the scale of loss is much bigger when institutions managing cryptocurrencies fail. Many of the major scams or hacks involving cryptocurrencies that resulted in huge financial disasters are around the exchanges. The world’s most sophisticated adversaries are working day in and day out to break into these cryptocurrency exchanges, and the bounty, the blockchain, is unbelievably huge.

Exchange Failures

Mt. Gox was one of the first and most prominent Bitcoin exchanges based out of Japan. This was originally launched around 2010 and has grown so fast. At that time, the majority of the Bitcoin transactions were going through this exchange. Mt. Gox had a large number of Bitcoins while also holding the Bitcoins of its customers. The Bitcoin revolution and an urgent need to build exchanges were the needs of the time. The international law of trading cryptocurrencies as an asset was in its infancy stage. The Bitcoin exchange software development process was also an ad hoc process rather than building something with lots of jurisprudence. Obviously, lots of critical vulnerabilities were lurking inside them.

Right from 2011 onwards, security breaches started occurring on a regular basis at Mt. Gox. Most of these incidents were “dealt with” by hook or crook to make sure that the exchange was running smoothly. Many times the lost Bitcoins of the customers were returned or compensated, as the exchange was huge and had enough liquidity in terms of both Bitcoins and fiat currencies such as the US Dollar. Many security breaches happened during this time, including customer database leaks. Lots of legal battles with the local government and the US Department of Homeland Security ensued.

In February 2014, the issues reached a climax, and after numerous complaints of transaction delays in online forums, Mt. Gox suspended all transactions and paused withdrawals, and bankrupt deliberations began. The damage from the whole crash was approximately 850,000 Bitcoins and out of that, most of it was their customers’ Bitcoins. The legal battles are still going on as we speak, and it is still not clear who is getting the compensation and how that is dispensed.

Bitfinex [3] is a Hong Kong based exchange that suffered a hacking incident in 2016 and lost more than 100,000 Bitcoins. There was an inquiry into the event, and it is questionable whether they could recover all the cryptocurrencies they lost. This is one exchange that recovered well and tightened its security to continue its business.

Key Loss

QuadrigaCX was an exchange based out of Canada. They filed for bankruptcy in 2019, citing the fact that a good amount of their Bitcoins stored in a cold wallet, which was under the custody of its diseased CEO, Gerald Cotten.

There was a report titled QuadrigaCX: A Review by Staff of the Ontario Securities Commission [4] that says, “In reality, Cotten spent, traded and used those assets at will. Operating without any proper system of oversight or internal controls, Cotten was able to misuse client assets for years, unchecked and undetected, ultimately bringing down the entire platform.” Many articles say Mr. Cotten was actually running a Ponzi scheme.

Mismanagement, Fraud, and Liquidity Crisis

The world has seen so many financial crises by now. Even in the cryptocurrency world, we have seen many, and one that has impacted many institutions, investors, and individuals alike is the FTX collapse and the bankruptcy [5]. FTX, the creator of the FTT token, was a Bahamas based cryptocurrency exchange. It had subsidiaries in many countries, including the USA. Many industry pundits consider that the FTX fall was one of the biggest in the history of the USA. FTX was founded by the American cryptocurrency wizz kid Sam Bankman-Fried. Mr. Bankman-Fried had founded a few other companies as well, and most of them have also gone down with FTX.

It is extremely difficult to come up with a chronological list of events that culminated in the failure of the FTX exchange. This organization tried to do too many things and freely exchanged its FTT tokens and funds with other companies founded by Mr. Bankman-Fried. Obviously, this was not as per the financial guidelines. Many members of the FTX board knew about this and closed their eyes. At the same time, the company was also going through legal proceedings. At this time, Binance [6], who was holding lots of FTT tokens, decided to unload. The potential acquisition of FTX by Binance was also called off. Lots of panic selling of FTT tokens happened because contagion fears in the market brought its price down, and at the same time, FTX didn’t have enough liquidity to honour the withdrawals.

In summary, this was a clear case of mismanagement of funds, misuse of FTT tokens, mishandling of other cryptocurrencies such as Tether, fraudulent intents, and liquidity crises happening all at the same time. Sam Bankman-Fried pleaded not guilty, but in the first trial itself, he was found guilty of all the charges. The trials are still going on. The former CEO of Binance – Changpeng Zhao – is also facing a similar situation of fraud. As of now, Binance is still operating, but you never know what is in store for that company as Mr. Zhao has pleaded guilty to violating many compliance requirements.

The Road Ahead

The greed of homosapiens knows no bounds. If systems are built on a strong foundation and maintained well, that is manageable. But if there are loopholes in the system or the ability to manipulate without the public’s notice, at some point they are going to be exposed. The gravity of the situation will depend on the impact of the system in question. Cryptocurrencies such as Bitcoin are still thriving even after seeing lots of handling failures at the hands of individuals and organizations. It is a herculean task to list out all the minor and major debacles that have happened in the cryptocurrency world.

But still, there are lots of very interesting developments coming in this space. The blockchain technology is very useful and has been adopted worldwide in so many application areas. Major investments are coming in this area. New financial products such as Exchange Traded Funds [7] backed by Bitcoin are under serious discussion. OpenAI CEO Sam Altman promotes the crypto project Worldcoin [8] which combines identity, blockchain, artificial intelligence, and machine learning. The concept of Bitcoin envisaged by Satoshi Nakamoto is an amalgamation of many subject areas, including software development, peer-to-peer networking, information security, mathematics, and cryptography to name a few, beautifully blended in his groundbreaking paper Bitcoin: A Peer-to-Peer Electronic Cash System [9] The economic impact cryptocurrencies have had is significant to the world economy. Lots of inter-disciplinary research work is happening in this field. Whether you are a technologist, institutional investor, individual investor, or enthusiast, the cryptocurrency world is an absolutely marvellous area to keep an eye on. It is going to stay in some form or another, for good or bad.

References

[1] BlackRock

[2] What Are Crypto Exchanges And How Do They Work

[3] Bitfinex

[4] QuadrigaCX: A Review by Staff of the Ontario Securities Commission

[5] FTX collapse and the bankruptcy

[6] Binance

[8] OpenAI CEO promotes crypto project Worldcoin

[9] Bitcoin: A Peer-to-Peer Electronic Cash System

To receive updates on detailed analysis and in-depth interviews from The AIDEM, join our WhatsApp group. Click Here. To subscribe to us on YouTube, Click Here.

Whether you’re a seasoned trader or a novice, they will equip you with the tools you need to stay ahead in the crypto market.Gain insights into Bitcoin’s historical price trends, market sentiment, and real-time data.The recent drop in price of bitcoins and other alt coins is influenced by various issues like rising inflation, the Russia-Ukraine War, an energy crisis, and the downfall of platforms like Terra and FTX.An early prediction into the first quarters of 2024 is that there will be a boom in bitcoin price and other coins, some well known investors has doubled their coins for a flourish ROI ,using this as a means of keeping you informed and making your financial burdens becomes less worrisome, they are here to guide you on how to trade with caution as you begin your crypto trip with Generationxweenie@Gmail.Com ,feel free to ask for help.